True Vine Letter readers who are familiar with my Forecast know that I am of the view that inflation is coming, but it is still a few years away. In preparation, I will be making some investments in various natural resource related companies. I have begun by compiling data on gold & silver mining companies and developing some methods of analysis to assist in separating the wheat from the chaff.

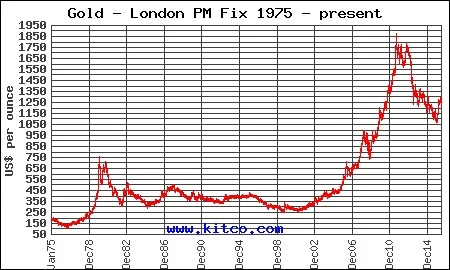

At present, my view is that the price of gold and silver are still going lower so I am patiently preparing for a better buying opportunity within the next couple of years. I plan on having a small buy list ready when that time comes. I have obviously prayed and reflected on the timing and so on and I have a few pieces of direction from the Holy Spirit. At this point I am thinking that gold may briefly touch the $700 to $900 range and silver the $7 to $9 range. I expect that after I finish analyzing the supply and demand situation over the next few months that the picture will become clear.

In the coming months I will be writing articles and research reports on various mining companies. Instead of explaining my methodology for evaluating the cost competitiveness of these companies every single time, I decided to simply lay it out here for linking and reference.

Mining for gold and silver—typically in remote regions of the world—is a difficult and costly business. It can be done profitability though when a company has rich deposits, experienced management, and disciplined execution. Investors need to pay close attention to the costs a miner incurs to ensure there will be cash left over to pay them and/or properly reinvest in the business.

In 2013, the World Gold Council put out good standards for measuring the cost of mining at various levels. They are pretty much an industry standard now for the large miners, who continue to be more financially transparent. However, they are not official accounting standards and there usage tends to vary a bit amongst the miners. What I like to have is my own method that standardizes the cost analysis of all miners and focuses on the ability of each one to produce cash flow for shareholders.

What follows are the three primary ways in which I analyze the costs of miners and ultimately their ability to produce free cash flow for shareholders. An excellent article by Joe Hamilton of Primary Capital was very formative to my development of this method.

1. Cost Effectiveness of Current Operations

To determine the cost effectiveness of a miner’s current operations, I do the following calculation:

Cost of Current Operations = Total Revenue - Net Cash from Operating Activities (adjusted for working capital changes) - Finance Costs - Income Taxes

This calculation essentially yields the cost for the miner to run their day-to-day operations. This can then be divided by the gold or silver production for the year to get a per ounce figure. This a comparative figure to the “Total Cash Costs (TCC)” number that miners disclose. It can be used to compare the operational efficiency of mining companies.

This figure excludes (1) the capital expenditures (i.e., longer term investments) made by the company to sustain and grow the business, (2) the interest paid that year on existing debt (borrowed in the past to fund current operations), and (3) income taxes.

2. Cost Effectiveness of Overall Business

To determine the cost effectiveness of a miner’s overall business, I build upon the first calculation with this one:

Cost of Overall Business = Cost of Current Operations + Finance Costs + Income Taxes + Sustaining Capital Expenditures

This calculation gives us all the costs paid to run the company for the year except for the capital expenditures made for exploration and future development. This can then be divided by the gold or silver production for the year to get a per ounce figure. This is a comparative figure to the “All-in Sustaining Costs (AISC)” number that miners disclose. It is more comprehensive in that it includes (1) the capital expenditures needed to sustain the ongoing business (at least until the existing mines run out), (2) the cost of financing existing debt, and (3) income taxes. It thus incorporates the cost ramifications of past management decisions, such as capital commitments for ongoing projects, borrowing, and taxes associated with deciding to operate in certain jurisdictions.

3. Long Term Cost Effectiveness

Lastly, to determine the total costs for the company’s existing and future mining operations we add in the capital expenditures for exploration and development.

Total Costs = Cost of Overall Business + Exploration & Development Capital Expenditures

This can then be divided by the gold or silver production for the year to get a per ounce figure. This is a comparative figure to the “All-in Costs (AIC)” number that only a handful of miners disclose. If you subtract the total costs per ounce from the company’s average realized price for gold or silver for the year, you get the per ounce free cash flow (for shareholders).

Calculating these different cost levels and comparing them over time is an excellent way to determine how effective management has been at extracting value from the company’s mining operations to benefit shareholders. By selecting the best one(s), you just might be able to get gold and/or silver to “grow” and actually pay you income.

At present, the most difficult part about these calculations is determining just what capital expenditures are “sustaining” versus “exploration & development.” The good news is that miners are increasingly becoming more transparent in disclosing how much was spent on what so this should get easier in the years to come.

Joshua S. Hall, ChFC

Disclaimer:

The True Vine Letter is a publication of True Vine Investments, the investment advisory business of Joshua S. Hall, ChFC, a Registered Investment Adviser in the U.S.A. The information presented in The True Vine Letter is provided for educational purposes only and not to be used or considered as an offer or a solicitation to sell or an offer or solicitation to buy or subscribe for securities, investment products or other financial instruments, nor to constitute any advice or recommendation with respect to such securities, investment products or other financial instruments. The True Vine Letter is prepared for general circulation. It does not have regard to the specific investment objectives, financial situation, and the particular needs of any specific person who may read this letter. You should independently evaluate specific investments and consult a professional before making any investment decisions.

Positive comments made regarding this article should not be construed by readers to be an endorsement of Joshua S. Hall's ability to act as an investment adviser.